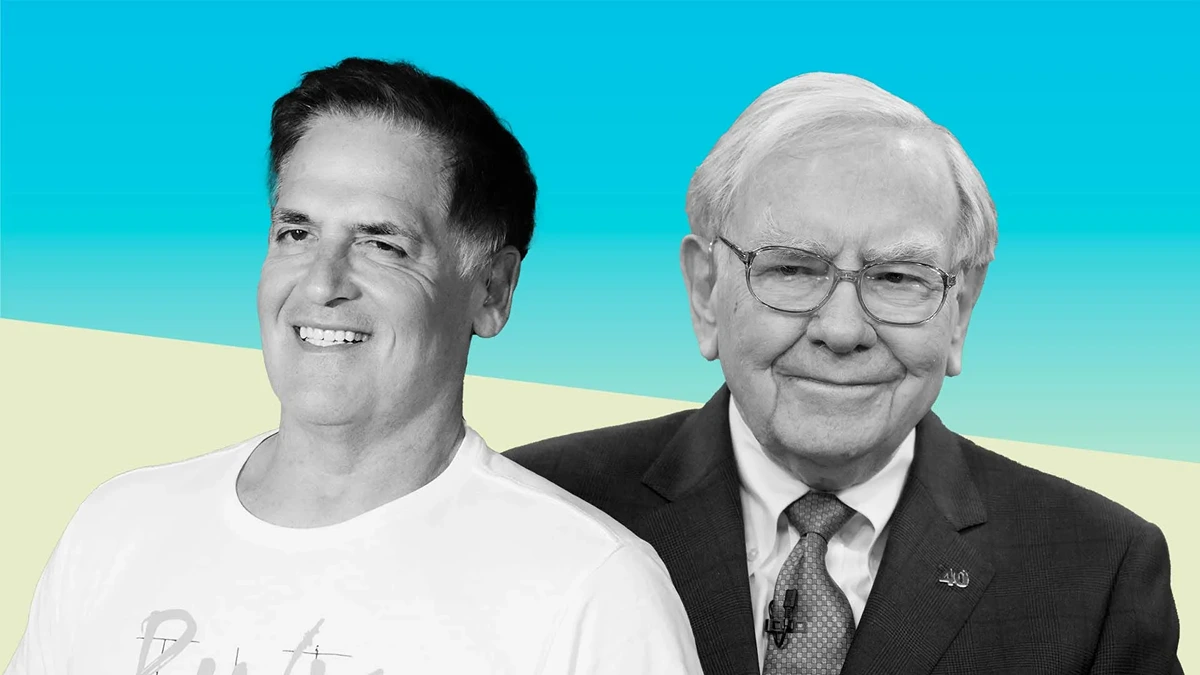

Warren Buffett, also known as the Oracle of Omaha, and Mark Cuban are two of the world’s greatest investors and billionaires. Berkshire Hathaway was led by Warren, who became the best long-term seasoned investor across the globe. However, neither of them reached their goal by following the same playbook.

Mark Cuban, the Shark Tank personality, made his wealth by founding companies, selling them at a margin, and reinvesting the money in early-stage businesses.

Irrespective of their different ideologies, there is a significant point where both of them agree: the most crucial investment that you can make is in your capability to improve with time. Thus, this foundational ideology influences their decision-making, starting from where they allocate their capital and their risk-taking approach.

Let’s dive deeper into Mark’s and Warren’s key investment philosophies. Also, let’s look at what points they agree on and disagree on.

The Core Truth They Agree On: Invest in Yourself First

Mark Cuban and Warren Buffett disagree on many different aspects of investing and developing a portfolio, yet they agree on one point. One of the greatest investments a seasoned investor can make is in their own ability via learning skills, getting knowledge, and improving judgment.

Buffett repeatedly suggests the same to other professional investors. Consequently, this investment includes professional abilities, formal education, and the constant growth of knowledge.

This is the most advantageous investment as it has zero wear and tear and continues to return dividends throughout your life with no inflation.

In a similar manner, Mark emphasizes the importance of personal growth as the basis of building wealth. Moreover, he presses on with constant learning and suggests taking risks, all of which require self-investment.

According to Mark Cuban, your investment in personal growth enhances your capability to assess opportunities and makes execution better.

Buffett’s Long-Term Value Investing Philosophy

As most of the investors know, Warren Buffett likes to read and learn from books; his strategic investment stems from the philosophy of value investing.

He learned this discipline from Benjamin Graham, and instead of going for short-term gains or recent trends, Buffett’s focal point is solid businesses. Also, he focuses on strong management or leadership, sustainability, and prices reflecting long-term vision.

Buy and Hold With Patience

One of the most prominent strategies of Warren is buy and hold. He suggests that investors must purchase shares in strong businesses or low-cost index funds.

After buying them, investors can hold their investments for a longer period of time. Subsequently, when the market goes down and everybody starts panicking, Buffett views the downturn as an opportunity to trade more shares.

Rather than predicting short-term movements, this investment approach capitalizes on the long-term expansion of growing businesses. Indeed, this avoids one of the most common mistakes of market timing.

Low-Cost Index Funds and Fees Matter

Buffett mostly suggests that investors who do not have the expertise to analyze individual businesses put their capital in low-cost index funds. Take, for instance, S&P Global 500 index funds.

Explicitly, his reasoning for this strategy is very simple, because the active managers often witness failure to beat the market. However, index funds capture wide market returns by reducing costs.

Emotional Discipline and Margin of Safety

The central philosophy of Warren Buffett helps investors to stay windless during market volatility, further preventing rash decisions. As per this discipline, he urges other investors not to let their investments be driven by greed and fear. He summed up his advice by mentioning, “fearful when others are greedy and greedy when others are fearful.”

Furthermore, Warren emphasizes buying assets at a significantly lower price below the intrinsic value to prevent any downside risk. This concept is called the margin of safety.

Know Your Circle of Competence

Buffett also introduces a concept named the circle of competence, which means you must only invest in companies that you understand. The simple notion behind this concept is to recognize your area of expertise and prevent mistakes due to a lack of understanding.

Mark Cuban’s Flexible, Opportunity-Driven Approach

On the other hand, Mark Cuban’s investment approach is more flexible and grounded in practicality and clarity.

Cash Is King

Mark emphasizes liquidity and argues that holding a large amount of cash can be a strategic position and advantageous, unlike Warren, who is a critic of cash as it loses its value over time.

According to Cuban, holding cash gives you the flexibility to react when other investors cannot, particularly during times of uncertainty. Mark simply quoted by saying, Cash is king. This strategic position of Mark Cuban is about seizing the right opportunity without liquidating any other holdings at a lower price.

Don’t Overprotect With Diversification

Mark has made waves by challenging the classic diversification suggestion. He has bluntly mentioned many times that diversification is overrated, especially for knowledgeable investors, unlike others who say diversity or die.

Additionally, this ideology means that investing in sectors you do not understand prevents significant bets on your ideas, further diluting potential returns.

Though this point of view is controversial among investors, Cuban does not mean that you must ignore the risk involved; instead, do not just diversify because it is crucial. Diversification gets returns when you completely understand the opportunity.

The Value of Sweat Equity

Mark Cuban also talks about a valuable form of investment, which is sweat equity. It is the time, effort, and skill set that investors put into developing a brand or improving their career. The Shark Tank investor believes that your own expertise and work can bring overwhelming returns when compared to financial assets.

Takeaway

Both the seasoned investors, Mark Cuban and Warren Buffett, work on a foundational discipline: invest in yourself, and your financial and educational literacy first.

Unlike Warren, Mark Cuban advises investors to hold a huge amount of cash, reserved for opportunities and emergencies. They promote the skill of not letting your emotions drive your financial decisions.