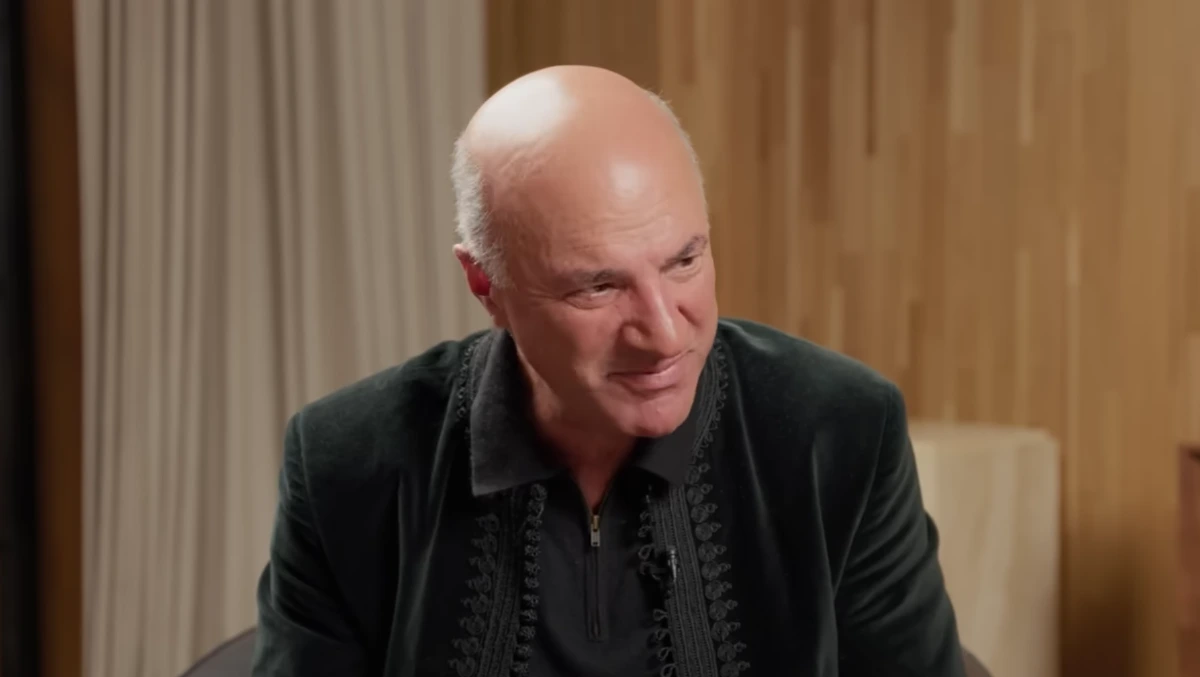

Kevin O’Leary believes Bitcoin could run into serious headwinds if quantum computing develops at a rapid pace. The Shark Tank investor, who has publicly supported the cryptocurrency, said its value could slide if future machines manage to break the safeguards that protect the network.

He noted that quantum systems might be able to crack the encryption behind Bitcoin more quickly than programmers can reinforce it.

At the moment, the network depends on tough mathematical puzzles that ordinary computers cannot realistically solve. If that layer of protection weakens, confidence in the system could take a hit, and prices could react sharply.

Kevin O’Leary Warns About Quantum Threat to Bitcoin Markets

Kevin O’Leary warned that quantum computers could one day crack the private keys that protect digital assets. If those keys are exposed, crypto wallets would no longer be secure and past transactions could be at risk.

He said this possibility is making large financial firms think twice. Many institutional investors are wary of putting more money into crypto while these concerns hang over the market. Until stronger safeguards are in place, some may choose to stay on the sidelines or reduce their positions.

Institutional Investors Examine Quantum Risk in Crypto

Mr. Wonderful said a number of banks and asset management firms are reviewing how resistant crypto networks are to potential quantum threats. They want to know if current systems would remain secure if computing power takes a major step forward.

He also mentioned that regulators are looking at encryption rules through the lens of future technology. In his view, Bitcoin’s durability depends on stronger and updated security standards. He referred to global research efforts focused on building encryption tools that can stand up to quantum computing.

🚨NEW: KEVIN O’LEARY WARNS QUANTUM FEARS MAY CAP BITCOIN ALLOCATIONS

Shark Tank investor Kevin O’ Leary (@kevinolearytv) said institutions remain cautious about quantum computing risks related to Bitcoin $BTC.

He stated firms are unlikely to exceed a 3% Bitcoin allocation until… pic.twitter.com/osZgQcWwEa

— BSCN (@BSCNews) February 17, 2026

Banks Await Clearer Rules Before Expanding Crypto Services

Banks and other large financial firms have been careful with their crypto exposure as rules continue to evolve. Many are holding off on expanding trading desks or custody services until regulators provide clearer guidance. They are also tracking how future security standards for digital assets may take shape.

Market analysts say large institutions are taking their time before deploying major funds into crypto. Several asset managers have made it clear they need firmer security guarantees before expanding their holdings in digital assets.

At the same time, exchanges and custody providers are monitoring progress around quantum-related threats and how they might affect the market.

Kevin O’Leary Pushes for Faster Security Innovation

Several companies are running controlled trials of updated encryption tools to assess how they would perform against future quantum attacks. Within the blockchain world, talk of quantum risk has grown louder, along with efforts to spread awareness and share practical safeguards.

Research groups are partnering with tech firms to study security systems designed to hold up against more advanced computing power. Some blockchain developers are building blended models that allow newer protections to work alongside older systems. That way, networks can improve security without breaking existing infrastructure.

Making changes to public key systems across decentralized networks is a slow and delicate process. Open-source communities are helping move that work forward.

All of these lines up with Kevin O’Leary’s broader warning. If crypto wants long-term trust from major investors, it has to stay ahead of emerging threats, not react after the fact.