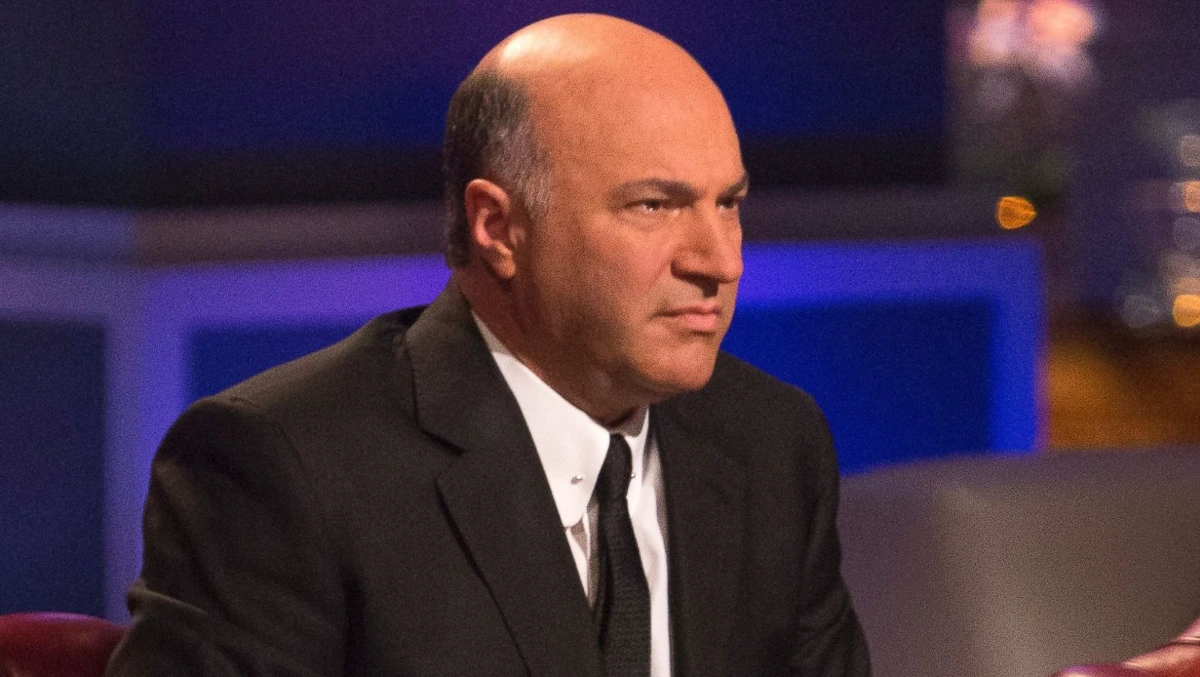

Kevin O’Leary, known to millions as “Mr. Wonderful” from Shark Tank, has never shied away from sharing his views on business and the economy. As the U.S. navigates political and economic shifts under President Trump, O’Leary’s insights offer a pragmatic look at how policy (and not politics) drives prosperity.

Many people might say that, in a capitalistic world, business and politics are very intertwined, but Mr. Wonderful conveniently disagrees with that. Achieving the kind of wealth Mr. Wonderful has probably means having a laser focus on making money above all else. However, as someone concerned with business and economics under Trump, his views have changed somewhat.

Kevin describes his views, saying, “You can’t make money with a politician. You make money on the policy they create through their administration.” He then goes on to speak positively about the Trump administration, noting how foreign investors are putting money into the U.S. and how the stock market keeps climbing.

O’Leary dislikes Trump’s tariffs, referring to them as a “headache,” and he’s firm that the Federal Reserve should stay independent. But that’s not all.

Kevin O’Leary On Business and Economy Under Trump

Mr. Wonderful has always been a man of many words, and they are mostly critical in nature. Here is what he had to say about the geopolitical and business landscape in 2025 in an interview:

For starters, Kevin was asked about his expectations for President Trump before he took office and how he would assess the administration’s performance in the economy.

To which he said, “The way I grade it is the way the world grades it: I look at capital flows and I don’t shill for politicians. I’ve said that countless times.”

Evaluating Policy Over Politics

Kevin went on to provide more insight into his views on politics, business, and policy. “I look at policy. You can’t make money with a politician. You make money on the policy they create through their administration. And so when you look at fund flows from sovereign wealth, which is a massive amount, the majority of money invested today comes from those funds all around the world.”

The funds Kevin talks about include contributions from the Middle East and the Nordic countries.

He goes on to further elucidate, saying: “That’s one metric to look at. So that’s confidence in the economy, in aggregate, of all the policies, including all the tariff wars and all the rest of it. And then you look at the U.S. domestic market itself, hitting all-time new highs when many people say, ‘How’s that possible? Why is it hitting new highs? What’s the reasoning behind that?’ ”

He mentioned that even without looking at everything in detail, those two indicators point to the administration performing well on policy.

O’Leary acknowledged that many people don’t like the way Trump operates, joking that they suffer from “Trump Derangement Syndrome.” He said he isn’t concerned with that. According to him, Trump is a president who “doesn’t give a damn if there’s a camera in the room” when he’s tearing something apart in the Oval Office.

Kevin acknowledged that it’s not the usual way of doing things, but he believes it doesn’t matter because the results are what shape the policy. Next, he was questioned about the impact of Trump tariffs on small businesses.

Business Climate and Uncertainty

The discussion turned to the current state of business, noting that “the sausage making, it hasn’t been pretty.” Many big and small business owners are rattled by the uncertainty, and while the market has adjusted, those managing supply chains still need a stable and sensible outlook.

The question arose whether the current environment is favorable for entrepreneurs, such as those on Shark Tank, who are starting or trying to grow their businesses.

Kevin responded that after 17 years on Shark Tank and observing entrepreneurial ventures across America, he has noticed a clear pattern. Most jobs are created by companies with five to 500 employees.

These businesses have endured a lot, including tariff wars, and have survived periods of seven to 19 percent interest rates as well as real estate meltdowns.

He further expands on it by saying that “the best time to start a business, proven by the statistics, is in chaos. Every time the American economy goes through some kind of a correction, it is a fantastic time to be an entrepreneur and start something. And then you have to figure out how to pivot through it.”

Kevin O’Leary on AI and Productivity

O’Leary also commented on how many companies have turned to AI. It has boosted productivity and helped push the market to all-time highs. He admitted, “I thought it was hype two years ago.”

Now every one of his companies uses AI, and it has proven very effective. He explained that it improves margins and lowers costs across nearly every sector of the economy.

Kevin then openly accepts how problematic tariffs are. He noted that in home building, companies are finding ways to manage expenses on things like softwood lumber and labor, often using AI tools. He added that big businesses, including those in the automotive sector, are facing similar challenges, but he expects these problems to be worked out over time.

Kevin on the Trump Administration

When questioned, “Did this administration bite off maybe a bit more than they could chew with a really unprecedented level of tariffs and trade war?”

Kevin said, “Well, you’re right. Nobody’s ever attempted to do 60-plus deals in 90 days. But my attitude is that it is what it is; deal with it. Don’t get deranged and get caught up in the political nature of what this is, because there are certainly politics involved. Focus on the policy so you can make radical investment decisions at minimal risk.”

Kevin further expanded on it by saying, “If you look for the path of least resistance, you want to find big opportunities because of disruption. You want to find something that has been completely dislocated and invest in that because of the policy changes.”

He was then asked about what advice he would like to give to the Trump administration. To which he said that he would not have supported the CHIPS and Science Act, calling it “a stupid act.”

O’Leary explained that after reading it, he found no real support for entrepreneurial or innovative businesses, describing it instead as a government handout.

He pointed out that much of the funding went to Intel, which he referred to as the biggest player in the industry. O’Leary acknowledged that Trump can govern as he sees fit, even when his decisions draw criticism.

He made it clear he wasn’t opposing everything the president did, only expressing his issues with the act, and said that others have raised similar concerns.

Advice for the President on Trade

O’Leary was asked what guidance he would offer the president on handling trade and tariffs to ease the impact on American businesses and consumers.

Kevin said he gives the same advice to every president he meets, i.e, their main job isn’t to pick winners and losers in the economy. “The American economy has been the most successful on earth for 200 years. We know what we’re doing,” he said, adding that less government involvement is always better.

When asked whether the administration is doing anything that could threaten the American dream, O’Leary said his view isn’t what matters most. It’s not about his personal opinion but about how the market and investors see things.

Shifting the focus, he brought up the importance of the Federal Reserve’s independence, saying, “Don’t mess with that. It works.” He explained that global investors put their money in the U.S. because they trust the balance between the executive branch and the Fed.

When it was mentioned that the president isn’t fond of the balance between the White House and the Fed, O’Leary replied that the markets see it differently. They like it,” he said, explaining that Fed board members are expected to focus on full employment and 2 percent inflation.

He pointed out that inflation is still well above target, so it’s not the right time to cut rates. “We should wait until we get a signal on where inflation is going.” The U.S. doesn’t want to end up like Venezuela, where hyperinflation destroyed the economy. O’Leary said he’s one of many voices defending the Fed’s independence.

Kevin O’Leary on Fed

Another question that was raised was, “Is this administration playing a dangerous game with the Fed, you think?”

Kevin’s response is, “They’re playing a game with the Fed. I don’t think you’re going to be able to stack the Fed like you can stack the Supreme Court. It’s not going to work that way. [Federal Reserve Chair Jerome] Powell, what does he have? Four and a half months left? He’s thinking about his legacy and is not going to kowtow to anybody. He’s just going to do what he thinks is right for the country.”

When it was suggested that he was hedging his opinion, O’Leary said he understood but wanted to clarify his approach. He explained that he works based on the information available to him and stressed the importance of letting the Fed set interest rates and manage employment policy. He added that the administration should be comfortable with this independence because the Fed has been very successful.

O’Leary said it’s hard to argue that Trump hasn’t been successful, pointing to strong foreign capital flows, job creation, and the performance of the S&P 500. He said he tells Trump, “Keep it up, but be careful. You can’t get everything you want.” O’Leary added that by these measures — capital flows and other key metrics — the administration has been “wildly successful.”

Impact of H-1B Visa Reforms

The question turned to the administration’s plans for the H-1B visa program. O’Leary was asked how he views these changes, which affect companies that bring in skilled workers who often go on to start new businesses.

Kevin said he understands what the administration is trying to do and what Howard Lutnick said about it. “He doesn’t want it to be abused by large tech companies that want to reduce labor costs by hiring people with H-1Bs. I get it, but that’s a broad stroke.

He said he is fine with targeting large corporations, but he worries about the impact on startups. “They can’t afford $100,000 if they can’t find an AI engineer. We’ve hired everyone we possibly can in America. It’s a highly, highly specialized talent.”

Being able to hire qualified AI engineers from countries like Pakistan or India would give startups a competitive edge globally. He concluded that the H-1B rules should be adjusted to apply only to large corporations that can afford it, so smaller companies aren’t disadvantaged.

O’Leary clarified that his own companies can manage under the rules and that he isn’t opposed to them. But he warned the administration, “We can’t hire all the engineers we need. We do not graduate enough engineers in America.”

He added that China is outpacing the U.S. in producing design engineers, AI specialists, and coders. O’Leary emphasized that since the U.S. is in a global competition with China, policies need to reflect that reality.

Shifting from trade policy to technology, O’Leary also discussed how AI and workforce policies are reshaping American businesses.

Business Leaders on Trade Uncertainty

Mr. Wonderful was asked how his CEO peers view the current trade uncertainty. And what is the general sentiment among the business leaders he knows?

The reality is that behind the scenes, most CEOs expect trade and tariff policies to eventually become reciprocal. “It’s going to be brutal watching this passion play out, but country-by-country, it’s going to end up reciprocal.”

When asked if businesses are comfortable absorbing the costs, O’Leary said nobody likes it. He explained that companies are telling their staff, “Let’s cut back on things we don’t need. Let’s use AI to enhance our productivity. Let’s find the middle ground, maybe pass off a small percentage of the cost to consumers, but let’s wait and see what the end game is.

Kevin’s Relationship With Trump

When asked about his relationship with the president, O’Leary said he doesn’t speak with Trump very often, but the president knows who he is.

Kevin pointed out that Trump focuses more on engaging with the people who shape the administration’s policies, since that’s where he can make a difference.

He said that Trump has tapped into the power of social media. Kevin expands it, saying, “His policy is first indicated on social media. About 90 days later, it’s written into law.” O’Leary recommended watching these signals to see how policymakers respond, adding, “Boom! Either it’s an executive order or it’s a new policy on permits or whatever it is.”

He emphasized that this approach gives everyone some time to understand the administration’s direction.

Trade Negotiations and Strategic Insights

The discussion turned to TikTok and just how significant its influence has become.

“It’s a huge deal. It’s an incredible deal,” he said, clearly impressed. He admitted he had been close to the deal for a long time and was struck by the price. When they first tried to syndicate it, they expected a forced closure by the end of January with a valuation around $20 billion. “$14 billion is outstanding,” he added.

Kevin praised Trump for what he called a brilliant move. Move in question? Convincing Chinese President Xi Jinping to join “the circle of friendship” in U.S. trade talks.

That change, he explained, shifted the whole landscape. Xi became a seller, and many buyers appeared. So far, only Oracle is confirmed on the cap table. “We’ll see who else ends up there,” he said.

He sounded confident about the deal. “I’m a big believer that this deal is going to happen,” Kevin said. He credited Vance and his office for handling the complex negotiations. Multiple administration members were involved. In the end, China agreed because staying in America’s “circle of friendship” mattered.

Business Over Politics

It’s clear that Kevin O’Leary approaches the intersection of business and politics with a mix of pragmatism and sharp observation. Like most people in the top 1%, he mostly chooses to be apolitical. His one-track mind is always predominantly locked in on what drives results. There is a clear focus on results over rhetoric.

Instead of politics as a whole, he narrows down to policy, the markets, and the opportunities that arise from disruption. Mr. Wonderful’s perspective is a great example of how success is often rooted in turning a blind eye to things that do not align with your goals, spotting patterns, and knowing when to act, even amid Twitter and tariff wars.

In the end, Kevin O’Leary’s philosophy remains pretty clear. Focus on what policies create opportunity, ignore political noise, and invest where disruption breeds growth.