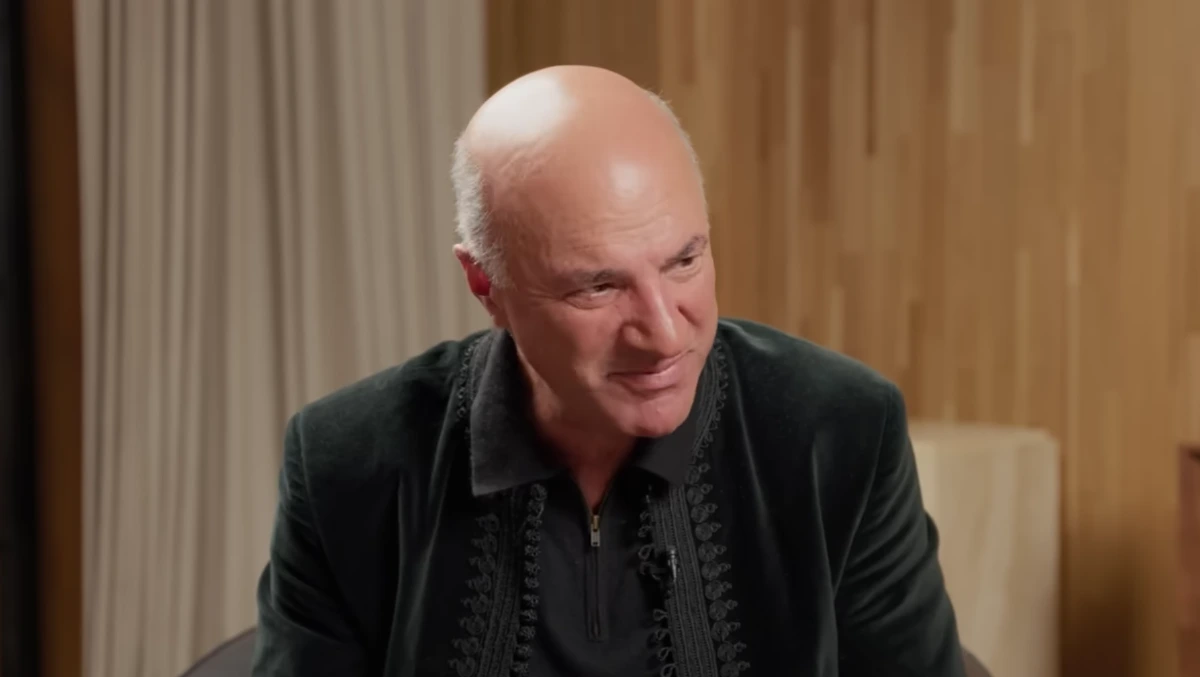

A $28 lunch might feel harmless, but Kevin O’Leary doesn’t see it that way. The Shark Tank investor calls it a waste of money and says it’s one of the reasons people struggle to build wealth.

Instead of considering it once in a while, conspicuous consumption, Kevin thinks it is straight up foolish and is burning through your savings reserve.

Kevin has also previously commented on the idea, saying, “A coffee for five dollars and fifty cents. You go to work, you spend fifteen bucks on a sandwich. What are you, an idiot? Most people, particularly working in metropolitan cities, are just starting out their jobs, making the first $60,000, piss away about $15,000 a year on stupid stuff.”

Why People Are Broke According to Kevin O’Leary

In a clip from The Diary of a CEO podcast shared on Instagram with the caption “This is why most people stay broke…,” Kevin O’Leary talks with host Steven Bartlett about the kind of everyday habits that quietly drain people’s chances of building real wealth.

O’Leary told Bartlett that he gets frustrated when he sees young people earning around $70,000 a year, spending $28 on lunch. He called it “stupid” and said that the same money could grow for decades if it were invested in an index fund earning 8 to 10 percent a year.

And he’s not being dramatic for a change. One $28 lunch a week adds up to about $112 a month. If that money were invested at 8 percent for 50 years, it would grow to nearly $800,000. O’Leary’s sermon is simple; it’s not about the meal, it’s about the missed opportunity that it amounts to over time.

It’s a common routine for many people, unfortunately, to Kevin’s dismay. A survey from ResumeBuilder shows that most workers do it at least three times a week, with nearly half spending $20 or more each time. At the same time, 75 percent said an extra $250 a month would make a real difference in their lives.

This is where Mr. Wonderful’s not-so-wonderful blunt remark gains validity. The money exists, people are just spending it on food, sweet treats and other miscellaneous retail therapy purchases.

The Closet Check That Might Change Your Spending Habits

Anyone familiar with O’Leary knows this is nothing new. He’s talked before about skipping pricey coffee runs and sticking to cheap homemade brews instead. His philosophy centers on being smart with small expenses, planning ahead, and letting steady investing build real wealth.

Kevin didn’t explicitly dictate what people should eat instead. But given his past advice, it’s easy to guess he’d prefer you pack your own lunch rather than burn through $28 at a food court.

The brash Shark Tank investor didn’t stop at lunch. He turned to another common spending trap, i.e., clothes. He told listeners [of the podcast] to take a closer look in their closets. What to look for? The fact that most people regularly wear only a fraction of what they own.

He then compared that mindset to his mother’s approach to fashion. Kevin’s mother only bought a couple of high-end Chanel jackets each year, but they were built to last. O’Leary pointed out how her focus was on quality and not on trends.

He also didn’t fail to brag about how a well-preserved Chanel jacket from the 1950s is now worth a small fortune.

Kevin O’Leary’s 15% Rule for Building Real Wealth

One important clarification is required to avoid the wise words of Mr. Wonderful being twisted. O’Leary isn’t saying people shouldn’t spend money. All he’s saying is that they should think before they do.

A pricey lunch or a $120 hoodie might not seem like much on its own at the time. But when those choices pile up over the years, they quietly drain your financial growth.

On the constructive advice side, Kevin also said young workers should be investing about 15 percent of what they make. For example, on a $60,000 salary, Kevin’s 15% formula yields $9000.

Starting early with something like that and staying consistent with it can allegedly build real financial freedom (even without a higher income).

Saving is Harder When the System is Built to Make You Spend

While some parts of Kevin’s advice may not be in touch with today’s reality, like how most people can only dream of buying two designer jackets a year. Or how saving conceptually is not as easy as it used to be in today’s hyper late-stage Capitalism, where everything is built around making you spend more, it is still worth a shot.

Kevin’s advice negates the fact that people need something to keep going. Be it a meal after a long day at work, or clothes, because people cannot buy luxury in the first place. It’s “incentivization” in business terms, but just a personal exercise of it to survive another day.

The Cost of Living vs. The Cost of Advice

After all, what good is working 8 – 10 hours a day and then not being able to have a meal of your liking? Everything is affected by inflation, which keeps increasing every year.

Maybe Kevin should provide a 15% formula for tackling that, too. Most people in our generation cannot even dream of owning real estate, something that was not the case in Kevin’s.

Not to mention the soaring rent prices.

Mr. Wonderful bases his advice on numbers and statistics, but he ignores the human cost and the toll Capitalism takes in today’s world. Curtailing spending habits no doubt can benefit an individual, but the advice loses its gravitas when it fails to compare the socio-economic backdrop of when his mother was buying Chanel jackets back in the day vs today.

Small Choices Today Shape Your Future

At its core, Kevin O’Leary’s advice is about being aware and not living in the candyland of denial. It’s not about cutting out every coffee or lunch, but about understanding how small habits shape your financial future. You can still enjoy the things you love.

As a consumer, you just have to make sure that they fit within a bigger plan. A little intention behind your spending today can make a huge difference in the life you get to live tomorrow.