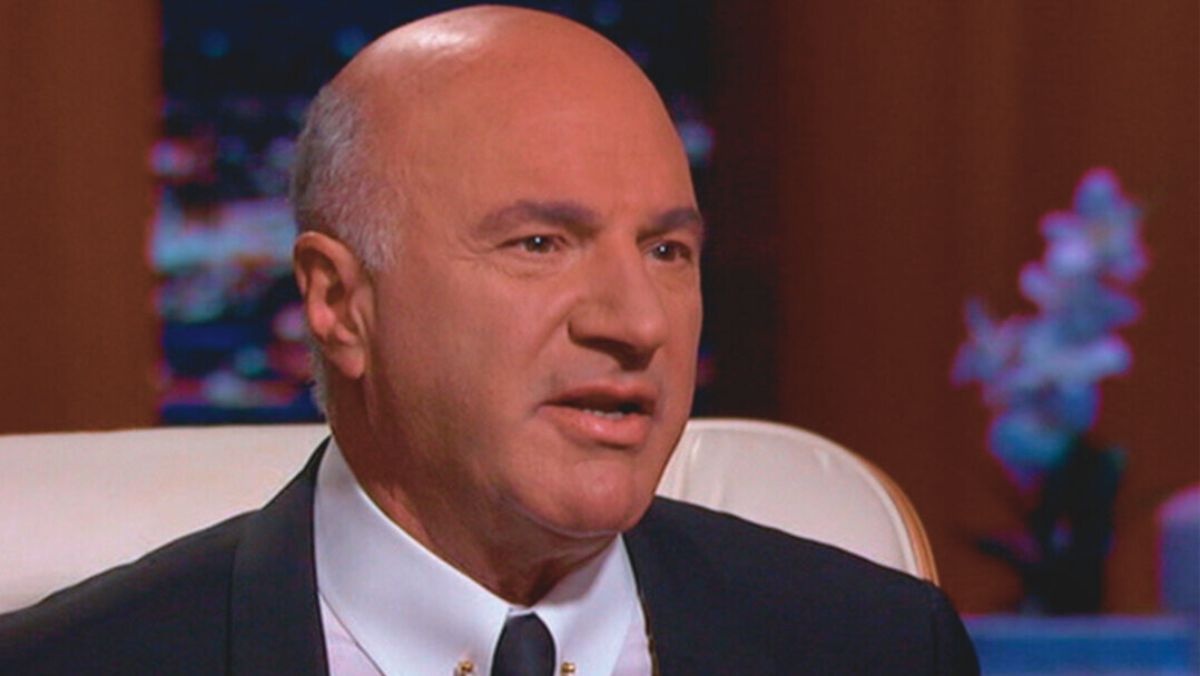

Despite being widely regarded as the most cut-throat business-minded figure on Shark Tank, Kevin O’Leary says the chase of monetary means is not what keeps him going. Kevin once said in an interview that “It’s about the personal freedom, not the money.”

Kevin O’Leary says his path to financial independence was driven by the simple habit of enjoying figuring things out. Problems spark ideas. Ideas turn into solutions. Solutions create value.

Kevin O’Leary’s Millionaire Investing Focus

Entrepreneurs step into uncertainty because they are focused on easing real frustrations for a clear group of customers. O’Leary says entrepreneurs take big risks because they are obsessed with fixing real problems for real people.

Mr Wonderful says, “You’ll wake up one day and be a multi-millionaire if you solve big problems for people.”

Turning Problem Solving into Smarter Financial Decisions

Many other well-known founders have also said things along the same tangent. Richard Branson pushes people to fix what is broken. Mark Cuban echoes that idea, calling problem-solving the heart of entrepreneurship.

The mindset applies to anyone, irrespective of their entrepreneurial ambitions. People can bring the same problem-first approach to investing and build smarter habits along the way. Here’s how to put that approach into practice.

How Problem First Thinking Leads To Smarter Investing

Kevin O’Leary insists upon the fact that some of the most profitable companies exist because they were built to address one stubborn issue. When the problem affects a large group, and the fix actually works, the payoff can be substantial.

Take healthcare in North America. Surgery in general (or US healthcare at large) has long been associated with perils and discomfort for patients. That pressure has driven surgeons to adopt robotic tools that enable smaller incisions, greater accuracy, and improved outcomes.

Now in 2025, climate change has become a big issue. Many forward-thinking companies are racing to address it.

The scale of the issue is evident in Canada, where extreme weather events caused $8.5 billion in insured damage in 2024. This was the costliest year so far, according to the Insurance Bureau of Canada.

Finding Opportunity in Real Problems

The idea comes down to focus. Pay attention to problems that are growing, not shrinking. Watch who is solving them well. Over time, steady value creation matters more than bold predictions. When you invest with that lens, the outcomes tend to take care of themselves.