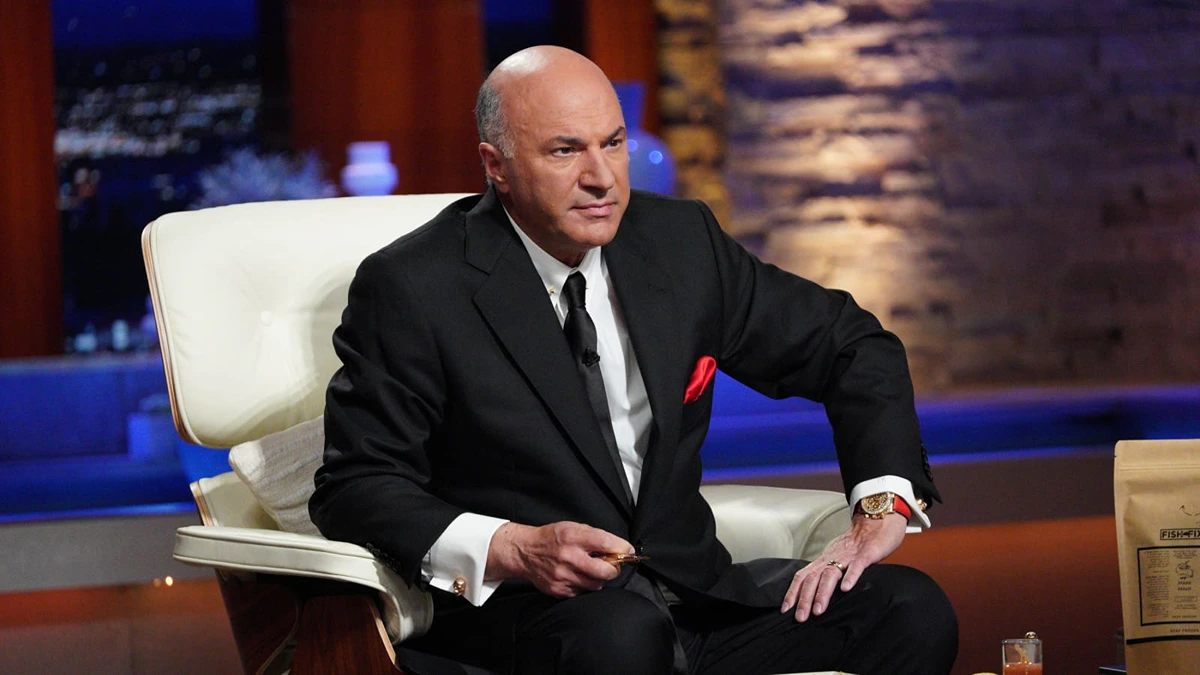

Prominent entrepreneur and celebrity investor on the television reality show Shark Tank, Kevin O’Leary, recently gave advice for people looking to buy houses. He posted on his X account that the greatest money trap people fall for is buying a huge house.

As we are aware that Mr. Wonderful is razor-sharp when it comes to finances, he says that taking a house on a mortgage suffocates one’s finances.

According to him, the risk lies in overleveraging market cycles and rates based on emotion rather than financial reality. O’Leary argues that many people buy houses on mortgage payments, consuming 50% to 60% of their income. They reach a point where financial suffocation begins.

The One-Third Rule: How to Stay Safe

Kevin also stated that the safest benchmark is to keep your mortgage at no more than one-third of your after-tax income.

Notably, monthly mortgage payments are only part of a major liability, as homeowners face additional expenses. It includes property taxes, utility bills, insurance, maintenance, and any potential repairs. These expenses go unnoticed, making homeowners fall into the biggest trap.

Mr. Wonderful points out that many buyers forget that they require an extra 10% to 15% of their income just for taxes and maintenance.

He further demonstrates his stake by noting that if mortgage payments remain within income limits, there is room for savings.

People can also invest their money and save it for major life changes, but high payments can wipe out that buffer. This makes homeowners very vulnerable to upcoming financial shocks.

Subsequently, a house with an asset but not liquid cash for everyday expenses makes people suffer in the long term. Kevin’s message is crystal clear: work the math first, and then fulfill your dreams of a huge house.

Why O’Leary Issues This Warning Now?

Let’s have a closer look at the key contextual factors driving Kevin’s recent warning, and why it matters in 2025.

1. High Interest Rates: Low-Rate Era Is Over

Kevin O’Leary previously cautioned that expecting mortgage rates to drop below 5% might be a dream. Moreover, he argued that the era where free money was available at a very low borrowing cost is gone.

Now, buyers must adjust their expectations for a home due to inflation, economic shifts, and rising interest rates. Given uncertain rate cuts and rising borrowing costs, buying a large, expensive home could be riskier.

2. Housing Market and Affordability Pressures Persist

Recently, people have been expecting that housing affordability will improve modestly, along with reduced monthly payments for median-priced homes. However, the baseline still remains hard for many families.

In this situation, if you purchase a house on an oversized mortgage, it can prove to be disastrous. This can tie you up with high mortgage payments, while other costs like taxes and maintenance keep on rising.

3. Emotional Bias In Homebuying: Bigger Isn’t Always Better

Kevin O’Leary says that many homebuyers make decisions based on their emotions about a big house, lifestyle, and status. However, their budget does not realistically support it.

He even argued that people’s emotional bias, combined with financial stress, leads to worse situations. A homeowner might buy an expensive house, but struggle with savings, cash flow, and even daily expenses.

O’Leary’s Recommended Approach: Start Small, Scale with Strength

Instead of buying a forever home, Kevin O’Leary advises purchasing a realistic path to ownership. He asks people to purchase a house that they can actually afford and then upgrade to a bigger house once their finances are healthier.

Key elements of his approach are:

- Stick to the thumb rule of keeping the mortgage payment under one-third of your after-tax income.

- While purchasing a house, remember to factor in the ongoing costs, such as maintenance, taxes, and upkeep, instead of just factoring in the loan payments.

- Do not let the dream home syndrome drive your purchasing decision. Select a home based on your financial situation, not just your aspirations.

- Also, pay your mortgage as soon as possible so that you can reduce your debt burden and free up cash flow for emergencies.

- Consider renting an apartment or house if you are starting off your career, especially if your income is unstable.

Thus, treat home purchase as a financial decision for the long term and not just as a wish list.

What Does This Mean for Homebuyers?

For anyone considering a mortgage in today’s economic climate, O’Leary’s warning serves as a timely reminder to run the numbers, not just chase the dream.

Calculate your take-home after-tax income. Multiply that by 0.33 or even lower, and treat that as the ceiling for monthly mortgage payments. Then subtract estimated maintenance, insurance, taxes, and utilities to see what is really affordable.

If your income is stable, your job is secured, and your life plan is settled, a home makes sense. If not, then renting might be wiser until financials and life become stable.

Hence, a smaller home that leaves you with cash for emergencies, investments, retirement fund, children’s education, or business ventures is often more valuable than an oversized home that drains your cash flow.