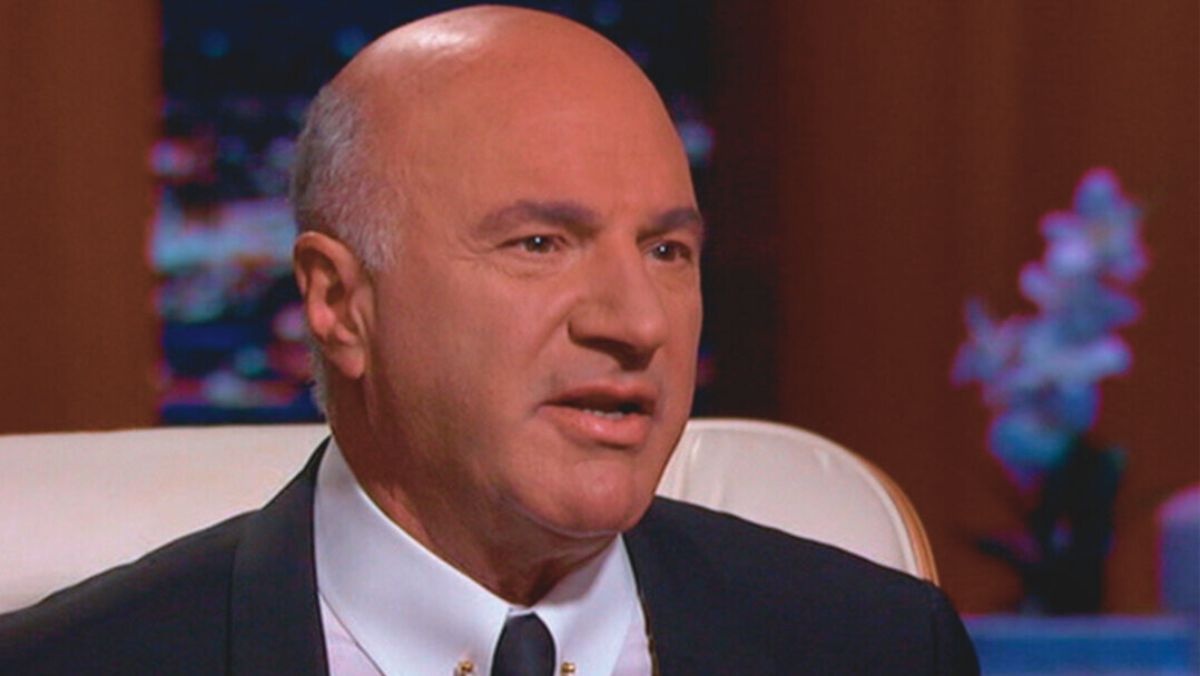

Kevin O’Leary is a well-known business figure. Many people know him from Shark Tank. On the show, he plays the tough investor. He asks direct questions about money and profit. He basically wants to know if a business truly works.

Outside of TV, he invests in companies and runs his own firms, and often speaks about the economy. He appears in interviews and news segments and shares his views on saving and spending.

Kevin O’Leary Warns Against Relying Only on a 401(k) for Retirement

Mr. Wonderful talks a lot about retirement planning. He explains how 401(k) plans work. He warns that many people do not prepare early enough.

Many working adults are not putting enough aside for their later years, and O’Leary calls this a growing problem. He says people often treat saving as optional while spending feels automatic. That habit, in his view, leaves too many unprepared when their income finally stops.

He also argues that people tend to picture retirement in vague and overly positive terms. People expect retirement to be simple, calm, and affordable. These assumptions kick in without really understanding the daily costs or lifestyle changes involved.

Without getting the basics in check, the planning becomes shallow or gets ignored entirely.

Below is a breakdown of the main issues he raises in interviews and public commentary around workplace retirement accounts and how people use them.

Many Workers Fall Behind on Long-Term Saving

O’Leary says a lot of workers let everyday comfort win over long-term security. Money goes to small treats and routines, while savings stay flat. Over time, that choice can leave a big gap.

He also notes that people often forget to adjust their savings as their pay rises. They earn more, yet their retirement plans stay in the same setting. That slows growth and limits what they can rely on later.

Treat saving as a priority and let it grow as your income grows. Do not leave your future to chance.

Poor Habits Can Quietly Weaken Long-Term Security

Kevin O’Leary often frames the issue as a self-control problem, not a money problem. People make quick spending choices that feel harmless in the moment. Those choices pull cash away from long-term goals. Saving becomes irregular or gets skipped entirely.

He also reminds people that government support in old age is limited by design. It is meant to help, not to carry the full load. Without personal savings, many people end up underprepared.

Kevin also talks about staying engaged later in life. Light work or consulting can bring both income and structure. He sees that as a smart way to stay active and reduce financial pressure.

Debt Can Block Long-Term Progress

O’Leary often warns that expensive debt works against your future. When a large part of your income goes to interest and minimum payments, there is little left to save. The debt keeps pulling money backward while you are trying to move forward.

He says this creates a quiet trap. People think they are standing still, yet they are slowly falling behind. Every dollar sent to a lender is a dollar that cannot grow for later life.

He also points out that this problem is widespread. Many people carry large credit card balances. That makes it harder to free up cash for saving. It also means money is shrinking instead of growing.

Retirement Often Costs More Than People Expect

O’Leary says many people picture retirement as a long break filled with hobbies and rest. They imagine lower stress and fewer expenses. Real life often looks different. Some retirees feel restless. Many also face higher costs than they planned for.

Health care is a major part of that burden. Medical bills can rise sharply with age, and they can last for decades. That alone can strain even a solid savings plan.

His point is practical. Do not guess what retirement will cost. Do the math. Think about housing, daily living, and medical needs. Build your plan around real numbers, not a hopeful picture of the future.

Optimism Alone Will Not Build A Strong Nest Egg

Mr. Wonderful often warns that people expect their investments to do more than they realistically will. They picture a larger balance than what careful planning supports. That gap between hope and reality can leave them short later on.

He suggests using the final working years to reset habits. Spend less and save more is the mantra (who would have thought). Get comfortable with a simpler lifestyle. That shift makes the transition into retirement easier and lowers the risk of unpleasant surprises.

Clear Thinking Matters More Than Popular Advice

A lot of retirement guidance sounds comforting, yet it often skips the harder truth. According to Kevin, a stable future usually comes from steady habits built over many years, not from luck or perfect timing.

Counting on outside help can be risky. Employer matches, surprise gains, or sudden windfalls may never appear. They are better treated as extras, not as the foundation. The safest path is simple and boring.

Why Kevin O’Leary’s Message Connects With People

Money feels tighter for many households right now. Every day, costs keep rising. Trade policies and market shifts add more pressure. Debt is common, and savings often fall behind.

In that setting, blunt advice feels useful. Many people are not looking for comfort. They want clear direction. They want to know what to do next.

That is where his voice lands. He offers simple steps and firm opinions. The tone is sharp, yet the goal is practical.

Help people prepare. Help them feel more in control of their future and help them reach retirement with less stress and fewer surprises.

What Kevin O’Leary Gets Right About Retirement and Money

At the end of the day, the point is not to sound tough or smart. It is to get people to look honestly at their money.

Spending habits, debt, and saving are not exciting topics, yet they shape what life looks like later on. Ignoring them does not make them go away. It just pushes the problem forward.

What really helps is staying consistent. Save when you can. Cut back where it makes sense. Deal with debt instead of carrying it forever. Those simple choices, repeated over time, do far more than any big promise or clever trick. That is what makes the future feel steadier and less uncertain.