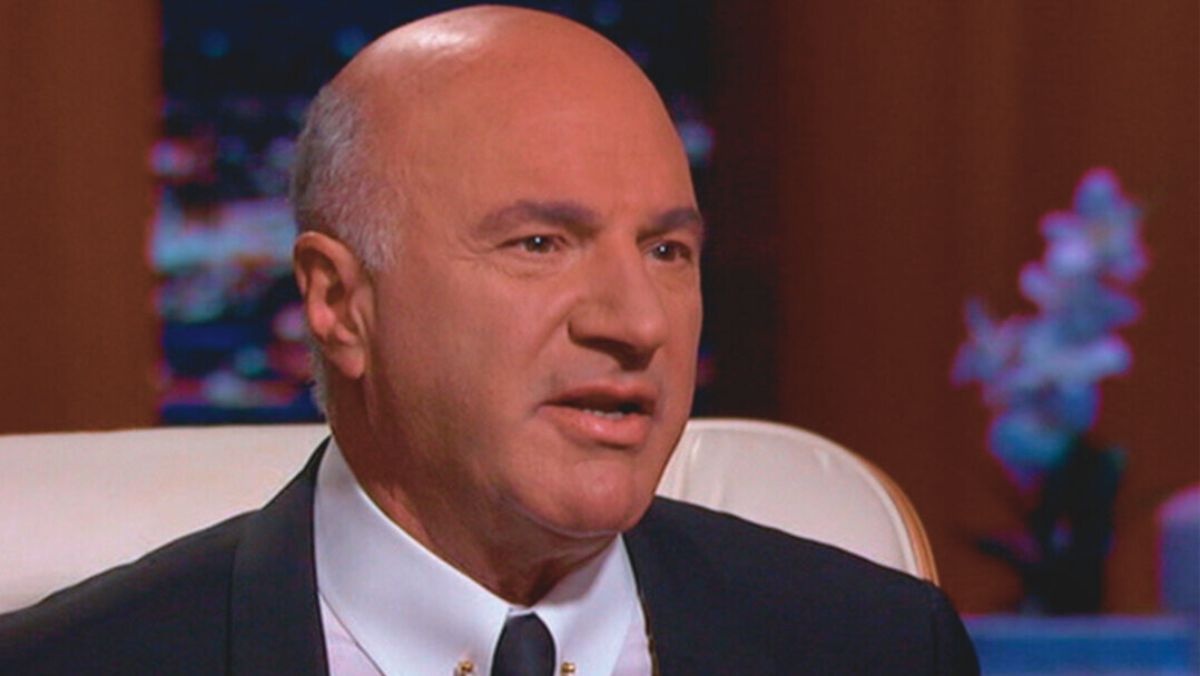

Kevin O’Leary said that Congress is likely to move forward with crypto market structure rules ahead of the 2026 midterm elections on January 23, 2026.

He made the case that waiting any longer just does not add up. The industry has reached a size where uncertainty starts to affect real people, not just companies. With so many investors involved now, pushing the decision off again feels less like caution and more like avoidance.

Kevin O’Leary Predicts a Crypto Regulation Date

Kevin O’Leary struck an optimistic tone in a recent interview with CoinDesk. He said he expects progress soon. Mr. Wonderful even pointed to a specific window. He suggested mid-May as a realistic moment for the legislation to move forward.

Kevin’s comments reflected confidence that talks have advanced beyond speculation and into a phase where real decisions are being made. He explained this by saying, “I think it has to because these bills are written by staffers…the staffers are spending on this bill probably 80% of their day right now.”

Kevin O’Leary pointed to stablecoin rewards as the main reason talks keep stalling. He said that the issue alone is driving most of the uncertainty around the bill. Still, he sounded cautiously optimistic.

The Shark Tank investor noted that a middle ground could be reached if both sides are willing to bend.

Kevin O’Leary on Competition and Fair Rules in Crypto

Kevin O’Leary took issue with the provision. He argued that it creates an uneven system. This happens by blocking crypto platforms from offering rewards on unused stablecoin balances, which makes little sense.

In his view, it tilts the rules unfairly and runs against the idea of open competition he believes the market should be built on.

The Debate That Stalled the Crypto Legislation

Kevin O’Leary is echoing a line of thinking shared by others in the industry. The head of Galaxy Digital, Mike Novogratz, has suggested a middle ground where rewards apply when stablecoins are actually used, but not when they sit untouched.

That disagreement quickly spilled into the legislative process. Coinbase pulled its support for the bill just hours before a scheduled vote. With that backing gone, lawmakers paused the markup, pushing the proposal into an open-ended delay.

CEO of Coinbase Brian Armstrong called for equal rules across the board and argued that crypto companies deserve the same treatment as the rest of the financial system. He also argued that users deserve the ability to earn a return on their stablecoins, pointing to a yield of about 3.8% as a fair benchmark.

Brad Garlinghouse has taken a more optimistic stance. The Ripple CEO described the proposal as meaningful progress, even with its shortcomings. His message to the industry was clear. Do not walk away now. In his view, the bill still moves things in the right direction and is worth continuing to fight for.

Why Long Term Portfolios Rely on Balance

Putting together a durable portfolio usually means looking past any single bet or hot trend. Markets move in cycles. Industries fall in and out of favor. No investment shines all the time.

That is why many people spread their money across different types of assets. Real estate, fixed income, metals, and even self-directed retirement accounts can all play a role. Some also lean on professional guidance to help keep things balanced.

This is not about squeezing out the biggest return possible. It is about not betting everything on one result. When money is spread across different areas, risk becomes easier to handle, returns tend to level out, and your outcome is not tied to whether one company or industry gets it right.

Kevin O’Leary’s Case for Moving Forward With Crypto Regulation

Another way to look at O’Leary’s stance is that he is focused on momentum. He sees crypto at a stage where hesitation carries its own risks. Markets can adjust to new rules, but they struggle when the rules are unclear.

He sees movement as better than paralysis. He tends to look at it as a choice between motion and stagnation. Standing still keeps everyone guessing.

Even imperfect rules give the market a reference point. Once there is something concrete in place, businesses can plan around it. Investors can judge risk with more confidence, and the industry can stop waiting and start moving forward.