Shark Tank mostly thrives on bold pitches and products. But in Shark Tank Season 17, Episode 8, a simple first-aid product sparked heated negotiations among the investors. This type of negotiation standoff has never been seen in the history of Shark Tank. Josh Lippiner did not pitch a sweeping healthcare breakthrough, but a focused solution to a common problem.

Rather, he talked about something which people experience in their everyday lives: a nosebleed. This led to tense negotiations over competing valuations, a reminder that even small niche products can spark the biggest fights.

Here is a breakdown of why Nampons led to such a standoff, and what this fight says about valuation, product simplicity, and investment strategy.

The Problem: Nosebleeds Aren’t Just Minor Annoyances

Nosebleeds happen to millions of people daily for multiple reasons. Moreover, almost all people use tissues and cotton, further hoping that the bleeding would stop. Of course, this is messy and often ineffective.

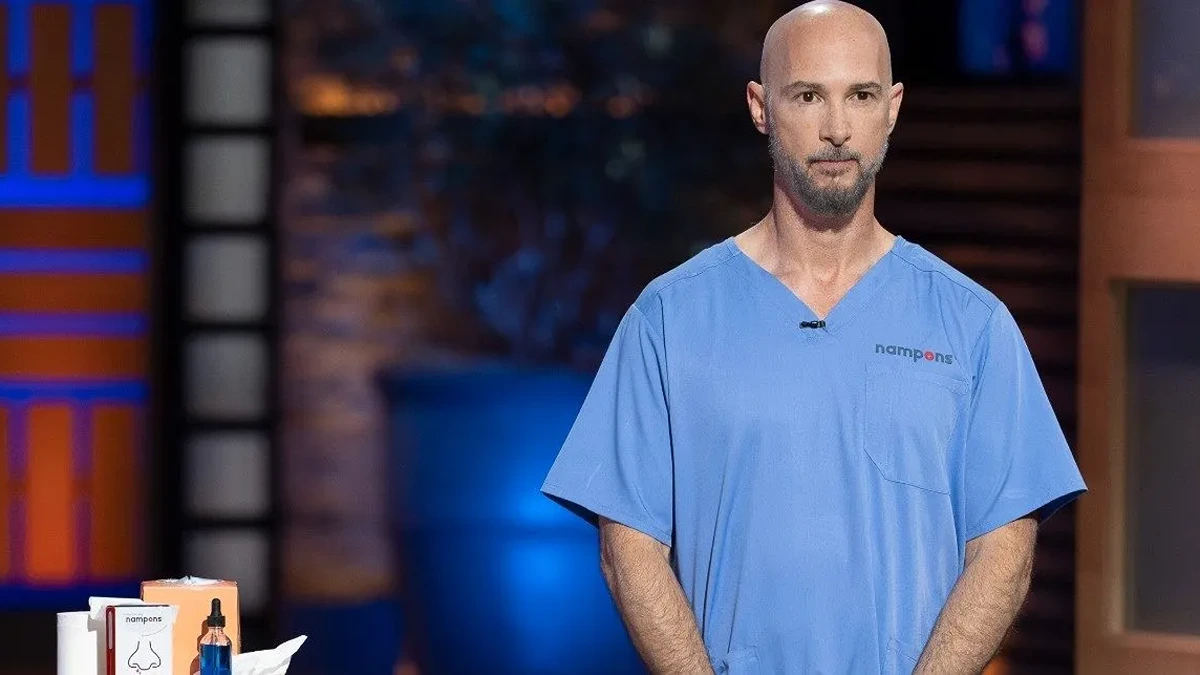

Josh Lippiner started Nampons, a sterile nasal plug made from oxidized cellulose that stops bleeding and expands when it comes into contact with moisture. It accelerates clotting and works more effectively than a tissue. Thus, this product was practical, simple, and can be kept in all the first aid boxes.

Josh suffered from nosebleeds from a very early age. He has a background in building tech brands and travel platforms. Nampons were born out of disappointment with existing alternatives. When he stepped into the Tank, he had already demonstrated successful sales and real-world utility. However, the real battle was over how much the product was worth and which investors were willing to invest.

The Pitch: Asking for Support and Stirring Debate

Josh came in asking for $350,000 in exchange for a 5% stake, further valuing Nampons at $7 million. He demonstrated Nampons in front of the Sharks by showing its design simplicity. As you can open the pack, insert it in your nose, and let it expand to stop the bleeding.

The product’s concept was very relatable and practically applicable because most people experience nosebleeds. Yet the Sharks, especially Kevin O’Leary, questioned the valuation, bluntly stating that the maximum valuation for Nampons would be $2.5 million.

Though Kevin was interested in the product because it fulfilled a need, he knew the revenue days were over. Now, investors buy a stake in any brand by looking at the valuation and scalability. This tension was at the very core of the negotiation standoffs that followed.

The Standoff: Valuation Versus Reality

Sharks like Lori Greiner, Michael Strahan, and Robert Herjavec saw potential in the product. They knew that Nampons could sit alongside Band-Aids and other first-aid items in medicine cabinets across the nation. But just one small variable, the valuation, led to the tightest standoffs in the history of Tank.

Nampons has strong sales, which stood at $3.4 million in 2024, generating $800K in net profit. The product does not have a patent; instead, it has IP protection. So, trademark and distribution were two of the major challenges faced by the company. That is how the fight started.

Crunching the Numbers

The founder felt the need to introduce royalty to bring some skin in the game, especially after Robert’s initial offer of raising the stake to 25%.

Basically, this means the returns are tied to per-unit sales rather than relying on equity. This is common on Shark Tank, specifically with Kevin O’Leary, who claims during the pitch that he likes royalty.

Consequently, Josh introduced new terms, asking for $350K in exchange for a 5% stake, plus a 5-cent royalty on each piece sold until they get back their investment. After hearing the new terms, Mr. Wonderful was back with an offer: $350,000 in exchange for a 7.5% stake and a 10-cent royalty per piece sold until he recoups the money.

Although Robert Herjavec and Michael Strahan were not particularly interested in royalty, they revised their offer. The new deal terms were $350K in exchange for a 10% stake and a 10-cent royalty until the investment is back. These deal terms reduced the valuation to what the Sharks considered reasonable. But Kevin increased the recoup amount from $350K to $500,000 at the same stake and royalty.

However, the final deal secured by Josh Lippiner was with Robert and Michael. The deal was closed as per the revised offer.

Takeaway

The debate over valuation was central to the extended negotiations and revised offers presented by the Sharks. Of course, the original $7 million valuation was very ambitious for a brand in the early-market phase. On the surface, Nampons appeared as a simple first-aid solution, but investors understood that scalability is still questionable.

This led to many questions and skepticism. Could it become a mass retail success? Could it be merged with other first-aid items across the globe? Thus, these questions influenced the deal structuring done by the Sharks, a combination of royalty and equity to align the risks.