Shark Tank Season 17 Episode 9

From baby sleep solutions to craft bars, here’s everything that happened in Shark Tank Season 17 Episode 9, including final deals.

Shark Tank kept the momentum of 2026 flowing with its ninth episode of the season, which was released on January 15, 2026. The Shark Tank season 17 episode 9 included the usual four pitches.

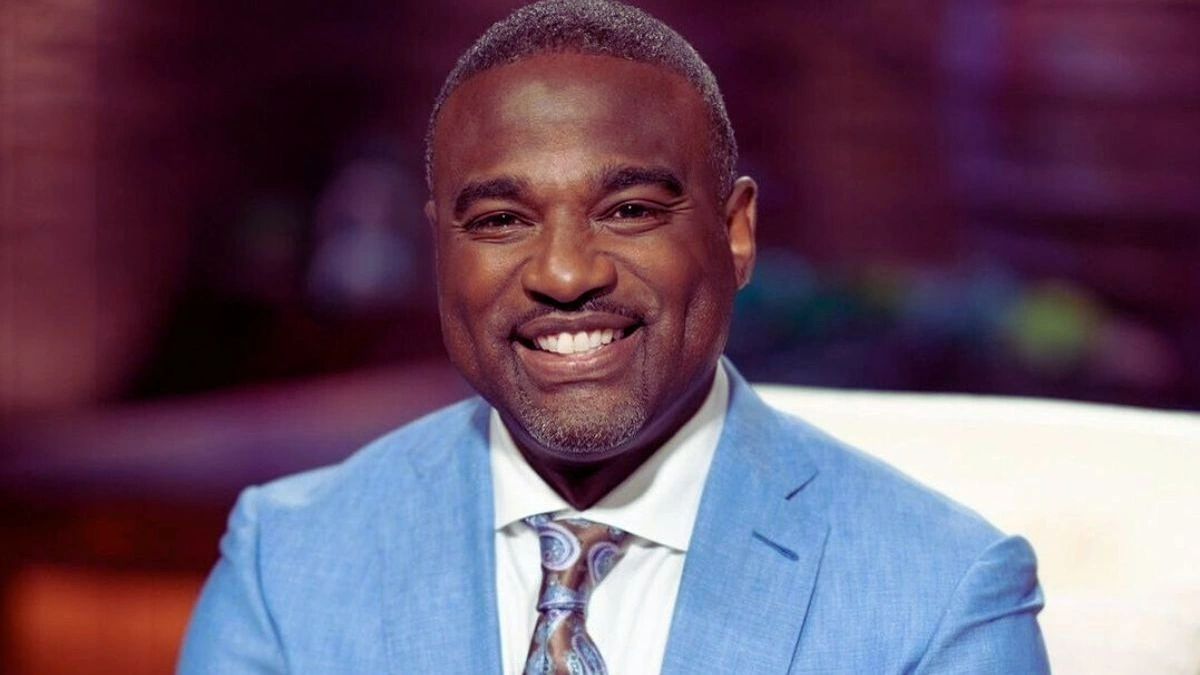

The Sharks for the episode were Kendra Scott, Kevin O’Leary, Lori Greiner, Robert Herjavec, and Rashaun Williams.

Shark Tank Season 17 Episode 9 – The Shark Investors and Entrepreneurs

Episode 9 brought in founders whose ideas came straight from real life. The pitches moved from a hands-on solution for sleepless babies to chocolate made without refined sugar, keeping the focus on simple problems and practical fixes.

Viewers also meet the minds behind a creative DIY studio and a service built around hosting poolside celebrations. Each founder steps in, hoping to win over the Sharks and strike a deal. Below, you can dive into the stories and ideas behind every business featured in the episode.

1. Sleepy Baby

The opening pitch of the episode came from Gary Harutyunyan and his wife, Siran Kirakosyan, who stepped into Shark Tank Season 17 Episode 9 to introduce their brand Sleepy Baby. They presented a portable baby patting device designed to help calm infants when parents need an extra hand.

The business was conceived by their own experience as new parents. That is, dealing with sleepless nights and the challenge of soothing a baby on the go. Their product zeroed in on offering practical support during the early and overwhelming months of parenthood.

Gary and Siran found their routines constantly interrupted by sleepless nights with their baby in early 2023. They tried rocking, patting, and a range of sleep aids. Still, nothing delivered consistent results. The exhaustion pushed them to think out of the box.

Using Siran’s medical background and working with electrical engineers, they developed a solution that felt natural and practical. By December 2023, they launched Sleepy Baby.

The device emits gentle rhythmic patting. And that is paired with white noise to help babies settle and stay asleep. The device also has an adjustable belt for a snug, secure fit.

It runs for several hours at a time and fully recharges in 90 minutes. The foundational idea was to make slumber easier for babies and far easier for parents.

Sleepy Baby Shark Tank Pitch

Gary and Siran entered Shark Tank asking for $70,000 in return for 25 percent of their company, placing the valuation at $280,000.

| Aspect | Details |

|---|---|

| Entrepreneurs | Gary Harutyunyan and Siran Kirakosyan |

| Featured Product | Sleeping Device for Babies |

| Deal Status | Deal Secured |

| Sharks Who Invested | Kendra Scott |

The concept caught the Sharks’ attention right away. Kendra Scott connected with the idea on a personal level and spoke about spending endless hours patting her own baby to sleep. Others were more cautious.

Robert Herjavec pressed them on traction. Gary revealed that they had sold 331 units so far. The sales had fetched them $21,000 in revenue. Kevin O’Leary and Rashaun Williams then questioned about how the product stacked up against alternatives in the market.

Siran explained that competing options can cost as much as $2,000, while their device sells for $63.99. With a landing cost of $9.40, the margins stood out. Kendra felt the price made sense, pointing out that exhausted parents are often willing to pay for real relief.

Robert related to the struggle of sleepless nights with his twins, though he acknowledged that every baby is different. Siran agreed, sharing that some babies still crave direct contact from their parents, even with helpful tools in place.

But Robert Herjavec also worried the patting motion might overwhelm some newborns instead of calming them.

Kevin O’Leary focused on the challenge of reaching new customers. He explained that strict privacy laws in the US make it hard to identify and market to expecting parents before a baby is born. With that hurdle in mind, he decided not to proceed.

Rashaun Williams echoed the caution, drawing on his experience investing in Happiest Baby. He described the baby care market as demanding and encouraged the founders to think about a wider product range. He bowed out soon after. Lori Greiner also passed, saying she did not see a clear path to scaling the brand.

With the other Sharks out, Kendra Scott stepped in. She offered $70,000 for a 50 percent stake, recognizing the early stage of the business and the effort required to grow it. Gary and Siran accepted and closed the deal on those terms.

Next up in the Tank was also a product that focused on what children want.

2. Bon AppéSweet

Thereasa Black stepped into Shark Tank Season 17 Episode 9 with a simple goal. She wanted to make chocolate that feels better to eat. She introduced her brand, Bon AppéSweet, and shared a lineup of chocolate bars made with cleaner ingredients.

The idea started at home. Her young daughter loved sweets, but most desserts were packed with processed sugar. That concern pushed Thereasa to look for better options. In February 2021, she launched Bon AppéSweet.

The brand is now known for chocolate bars sweetened with dates. There are no sugar alcohols involved. She uses fruit-based sweeteners across all her desserts. The products are free from soy and gluten. The cacao is sourced directly from Peru, staying aligned with her focus on quality and transparency.

When Robert Herjavec asked how she learned to make chocolate, Thereasa surprised everyone. She taught herself by watching YouTube videos. Her background in advertising also helped her understand branding and packaging. The story impressed the Sharks, though the focus soon shifted to numbers.

Bon AppéSweet Shark Tank Pitch

Thereasa Black entered Shark Tank asking for $75,000 in exchange for 10 percent of her company. That placed the valuation at $750,000. She shared three chocolate bars with the Sharks.

| Aspect | Details |

|---|---|

| Entrepreneurs | Thereasa Black |

| Featured Product | Healthy Chocolates |

| Deal Status | Deal Secured |

| Sharks Who Invested | Rashaun Williams and Robert Herjavec |

Once the Sharks sampled the bars, the reaction was largely positive. Rashaun Williams and Kendra Scott praised both the taste and the concept. Kevin O’Leary took a more analytical approach and asked about the numbers before forming an opinion.

Thereasa said each bar costs $2.48 to produce and sells for $8.50 online. Her products are stocked in 376 Walmart stores and are also sold at Whole Foods. Walmart’s sales have passed $100,000. Whole Foods added in 2023.

She also revealed that she raised $750,000 in 2024 at a $4 million valuation (she had reduced her valuation for her Shark Tank pitch). Revenue for the year stood at $526,000, and the company has yet to turn a profit.

Rashaun Williams made the first move and stayed true to Thereasa’s ask. He offered $75,000 for a 10 percent stake, without pushing for different terms.

Seeing that, Kevin O’Leary and Lori Greiner stepped aside. Both said the offer was strong and encouraged her to take it. Kendra Scott echoed that sentiment, praising Thereasa as one of the most impressive founders to enter the Tank.

Then the moment shifted again. Robert Herjavec proposed teaming up with Rashaun. Together, they offered $175,000 for 20 percent of the business. Thereasa agreed, locking in the deal with both Sharks on board.

3. Makers Social

Makers Social blends hands-on creativity with a lively bar setting. Guests sip cocktails while working with real tools. The space offers more than 30 DIY projects to choose from. Options include jewelry making, leatherwork, woodworking, and even concrete pouring.

Each visit is built around creating something personal. Guests pick a project and follow clear, step-by-step guidance. All tools and supplies are provided. Skilled project hosts are always nearby to help when needed.

No prior experience is required. Projects are ranked by difficulty, so beginners and seasoned DIY fans can jump in comfortably.

The bar adds to the fun with themed drinks like the Pop, Lock, and Socket or the Moscow Tool. The result is a relaxed, social experience where creativity and cocktails come together in one place.

Pando launched Makers Social in 2020. The COVID-19 shutdowns hit the world soon after. The business ran into major challenges almost immediately.

Makers Social Shark Tank Pitch

As part of the demonstration, Makers Social founder Megan Pando offered Sharks a fun task. They had to hammer and engrave their initials on custom-made leather wallets.

| Aspect | Details |

|---|---|

| Entrepreneur | Megan Pando |

| Featured Product | DIY Craft Bars |

| Deal Status | Deal Secured |

| Sharks Who Invested | Kevin O’Leary |

The sales mostly come from product kits. Alcohol adds up to a 30% share in total sales. When Robert asked about the sales in the previous calendar year, he was surprised to hear $546,000. Her main problem at the time of appearance is the fact that her capacity cannot hold too many people.

She is seeking more capital to set up her business at another location and have more customers. When in talks of expansion, Kendra advised Megan against franchising. She called Megan “the secret sauce,” and franchising takes away from that.

Following up on that advice, Kendra was the first one to tap out as she did not consider herself the best fit. Williams also followed suit, as his venture investor background did not fit the bill for Makers Social.

Lori also acknowledged Megan’s zeal but backed out because she did not see how she could add to the business requirements. Robert also acknowledged the quality experience that Megan was selling. But he was not sure of how to materialise an investment into more outlets, and on that ground, he backed out. He wanted a bigger return, and that was not on the cards anytime soon.

In the end, as Kevin joked, “all roads lead back to Mr. Wonderful.” He offered $150,000 for a 20% stake. All the Sharks were astonished to say the least at Kevin’s “generosity.”

After a little back-and-forth where Megan insisted on 18%, they shook hands on Mr. Wonderful’s original offer.

4. Cabana Boys Events

The last pitch of Shark Tank season 17 episode 9 rolled up to Nelson Brooks’ business called Cabana Boys. Cabana Boys Events is built around turning gatherings into standout experiences. Brooks sought $225,000 in exchange for 10% equity in his business.

The company operates across 10 destinations in the US and focuses on hosting and bartending for private celebrations. Its group of brands includes Cabana Boys, Cocktail Cowboys, Cocktail Boys, Cabana Girls, and The Cocktail Crew.

The team specializes in events like bachelorette parties, birthdays, group trips, and girls’ weekends. Trained hosts and professional bartenders take care of the atmosphere from start to finish. Every detail is tailored to match the group’s style and energy.

Services range from poolside hosting and pre-party setups to cocktail lessons and wedding bartending. The focus stays on smooth execution, clear coordination, and an upbeat atmosphere.

Clients get to enjoy their time without managing details. The aim is simple. Create moments that feel special, relaxed, and worth remembering long after the party ends.

Their average two-hour booking costs $550, and they make a 57% profit margin on that. One of the main reasons Nelson wanted an investment was to secure a head of customer experience in his staff in order to further scale his business. The lifetime sales at the time of the pitch were around $3.6 million.

Cabana Boys Events Shark Tank Pitch

Robert was the first one to back out, as he did not see his footing in a service-based business. Kevin also bandwagoned on the same rationale. He did not see much scope for scaling and making huge returns. Ergo, he was out as well.

| Aspect | Details |

|---|---|

| Entrepreneurs | Nelson Brooks |

| Featured Product | Party Staff |

| Deal Status | Deal Secured |

| Sharks Who Invested | Kendra Scott |

After sensing a lackadaisical response, Nelson once again pressed on how he’s the top running leader in his service industry. But it was not hard to tell that the Sharks were apprehensive about throwing their money into this business.

Rashaun Williams was the next Shark to tap out. He once again said how his venture capital-style investment did not fit in with Nelson’s demands, and for that reason, he was out. Kendra loved the business as she had once booked them for her own birthday party as well, but service-based businesses scare her, as she stated.

She mentioned how one of her companies did 25,000 events last year. She expressed ideas of working on this business along with her other event-based company. But the valuation did not sit right with her.

Kendra was willing to offer the required $225,000, but in return, she wanted a 40% stake. After a few rounds of back-and-forth negotiations, Nelson and Kendra shook hands on $225,000 for a 32% stake.

Update Segment

Cousins Maine Lobster reappeared in this episode after securing a deal with Barbara Corcoran in season 4. And their business has been on a rollercoaster that has only gone up ever since. Barbara helped them franchise out the business and they have gone from one food truck to a hundred food trucks, along with one thousand employees. They have also added a 7,000-square-foot distribution facility in Maine.

They only had $150,000 in sales at the time of their first appearance. Now, after 13 years, they have passed the $1 billion mark.

All Founders Walked Away with a Deal

Shark Tank of Season 17 Episode 9 brought together purpose-driven ideas and tough-minded investing in a way the show does best. The pitches reflected real-life problems, shaped by founders who clearly understood their customers because they were often their customers. Some deals came together smoothly, others took sharp turns, and a few demanded real give-and-take.

What stood out was the fact that all four entrepreneurs secured a deal, albeit one or two of them might be considered Sharkly. But as they say, something is better than nothing.

Check out other Shark Tank Season 17 Episodes. And check out our recap of Shark Tank Season 17 Episode 8.