Winning over investors on Shark Tank takes real grit. Each investor has a way of digging into a pitch that can rattle even the most confident founder. One might break down the cost structure line by line and push the entrepreneur to justify every choice. Another might zero in on sales strategy and question whether the company can survive in a crowded market.

Founders often walk in expecting excitement, but they soon realize the room can turn intense in seconds. Every claim gets tested, and every weakness gets exposed. The back-and-forth can feel more like a stress test than a business meeting.

Every now and then, the investors come across an idea they enjoy so much that they try to take over the whole company. Or when a good business idea does not have a good enough business strategy for execution.

When a pitch sparks that kind of reaction, the founder is suddenly facing a life-changing choice. Some decide to let go of full ownership because the payoff is massive, and the chance to see their idea grow with serious backing can be too tempting to pass up.

All-in Exits Where Founders Sold The Company

Here are three all-in exits where founders sold their entire company on Shark Tank.

evREwares

Ellie Brown and Becca Nelson walked into Shark Tank with a spark that was easy to notice. They had a knack for taking something ordinary and giving it a fun twist. Their idea centered on simple shirts and how to make them feel fresh without buying new clothes.

Their company, evREwares, offered reusable fabric stickers that cling to a basic tee. These pieces came in bright colors and playful themes, letting people switch up their style whenever they felt like it. The idea started back in 2011 when the sisters wanted a simple way to refresh their kids’ wardrobes.

The sisters stepped onto the Season 6 Episode 7 set asking for $100,000 in exchange for 30% of their company. Everything moved smoothly until they shared that their estimated profit for the year was only $50,000 and that they planned to slow things down afterward to rethink their direction.

That comment set off concerns about drive and growth. The pricing added even more tension, since each fabric sticker sold for $5 to $8. They mentioned that each one costs about $0.50 to make, to no avail.

Barbara Corcoran eventually spoke up and said what the others seemed to be thinking. She liked their creativity but questioned whether their business decisions matched the same level of strength as their designs.

The sisters asked the panel for guidance, but it did little to sway the room. One investor after another backed out and shared blunt feedback about the way the company was being run.

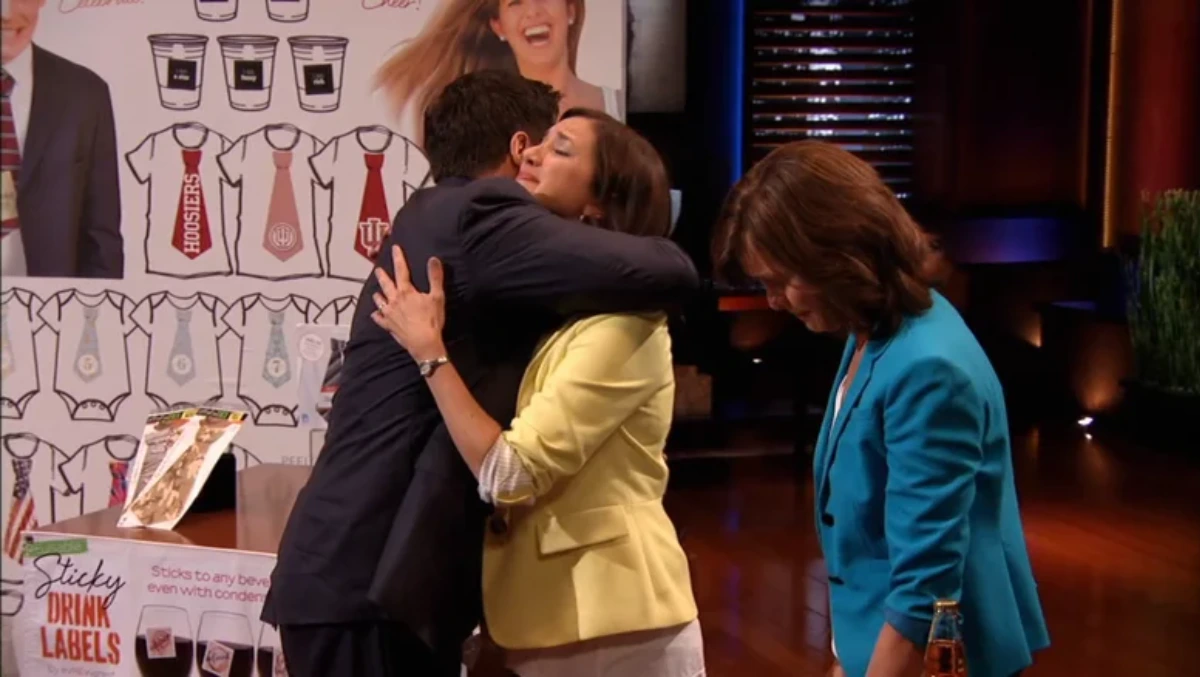

Mark Cuban picked up on how overwhelmed the founders felt and stepped in with a surprising proposal. He put $200,000 on the table to buy the entire company outright.

The sisters took a moment to absorb what this meant. They knew they were strong on the creative side but struggling with the rest. Even though it stung, they chose to accept Mark’s deal and let go of the business they had built.

Mark Cuban later reversed the deal after airing, and the company eventually closed.

Moki Doorstep

Zachary and Alyssa Brown stepped in front of the panel, asking for $150,000 in exchange for 5% of their company. Their product, Moki Doorstep, was a compact step that helped people reach the roof of their vehicle with far less effort.

It hooked onto the car’s metal door latch and gave users about three feet of extra height. Zach talked about his work as a firefighter and explained how that experience shaped his focus on safety when creating the design.

Back in 2017, they turned to Kickstarter to get the idea off the ground and brought in a little over $110,000. They had a partnership with Rightline Gear at the time of their appearance, along with a strong presence on Amazon, offering items like roof racks, roof tents, and car carriers.

Robert Herjavec reacted well to the pitch and seemed genuinely interested in how the product worked. Kevin O’Leary pushed back on the price point and decided to step away because it did not sit right with him.

Zach tried to keep the room engaged by mentioning a licensing deal worth $3 million over 7 years with a royalty rate of 12.5%.

Daymond John ended up being the only investor willing to put money on the table. He first suggested $450,000 for 20%, but the founders said they would prefer selling the whole company if they were going to part with that much control.

Once he heard that, Daymond shifted and offered $3 million for full ownership.

The two founders took a moment to consider it, then agreed to the buyout. The deal became one of the standout moments of their appearance.

HyConn

Jeff Stroope came in seeking $500000 in exchange for 40% of his company on Shark Tank Season 2 Episode 8. He introduced HyConn with calm confidence and explained that the idea grew out of years spent on the front lines as a firefighter.

Drawing on fifteen years as a firefighter, Jeff explained how slow connections on standard hoses can cost precious time. Then he demonstrated how HyConn snaps onto a hydrant in one smooth motion and comes off just as quickly. The difference in speed was clear even without technical details.

Jeff shared how this simple change could help crews get water flowing much faster during emergencies. His message was centered on practicality and the goal of giving firefighters a tool that supports them when pressure is at its peak.

Daymond John bowed out early because he did not connect with the direction of the company. Barbara Corcoran walked away as well, pointing to the price structure as her main concern.

Mark Cuban stepped in next with a bold proposal. He put $1.25 million on the table and added a fixed profit share plus a three-year employment arrangement in exchange for full ownership of HyConn.

Kevin O’Leary also showed interest, but only in the garden hose version of the product. He offered $500,000 for complete rights to that item and a 3% royalty on sales. Jeff weighed both paths and chose to move ahead with Mark’s offer.

Why Letting Go Can Be the Smartest Move

It is always striking to see how differently founders respond when the room pushes them to their limits.

Some walk away with a partner, and some walk away with a check that hands over everything they built. One moment you are defending your idea, and the next you are weighing an offer that changes everything.

These deals show that sometimes stepping aside and letting someone else take the lead can open doors you never expected. And it is so much better when that someone else is a Shark.

This is one of the best articles on the topic I’ve seen recently.

Very insightful — I’d love to hear your thoughts on related tools.

Nice post. I learn something totally new and challenging on websites